In the 1990s, prediction markets existed almost entirely out of public sight. They were not something gamblers talked about, bookmakers worried about, or everyday internet users even recognised. At that time, the idea of betting on elections, economic outcomes, or world events through a market system was mostly confined to universities, research labs, and experimental projects. The public did not see prediction markets as gambling, investing, or entertainment. For most people, they simply did not exist.

During the 1990s, the internet itself was still young. Online betting was in its infancy, and financial trading platforms were only just becoming digital. Early prediction markets, such as internal corporate markets or academic projects, were designed to test theories about collective intelligence rather than attract public participation. These platforms were closed, small, and often limited to a few hundred users. There was no marketing, no mass media attention, and no sense that prediction markets could become a consumer product.

That changed slowly around the turn of the millennium. By the early 2000s, prediction markets began to appear online in a way that the public could actually access. The launch of platforms like Intrade marked a turning point. For the first time, ordinary users could log in, deposit money, and trade contracts based on real-world events. These events included elections, interest rate decisions, economic growth figures, and geopolitical outcomes. While still unfamiliar to most gamblers, prediction markets now existed in the same digital space as online casinos and betting exchanges.

Even so, prediction markets in the 2000s were still far removed from today’s platforms. They were slow, text-heavy, and largely focused on politics and economics rather than entertainment. Most users were hobbyists, politically engaged traders, journalists, or academics. Liquidity was limited, interfaces were basic, and the concept required explanation. A typical online gambler in the 2000s was far more likely to place a sports bet than to trade a political outcome contract.

Public awareness during this period was selective rather than widespread. Prediction markets were discussed in financial media and occasionally referenced during major elections, but they never achieved mass adoption. Regulatory pressure, particularly in the United States, kept them on the margins. When Intrade shut down in 2013, prediction markets largely disappeared from the public gambling conversation.

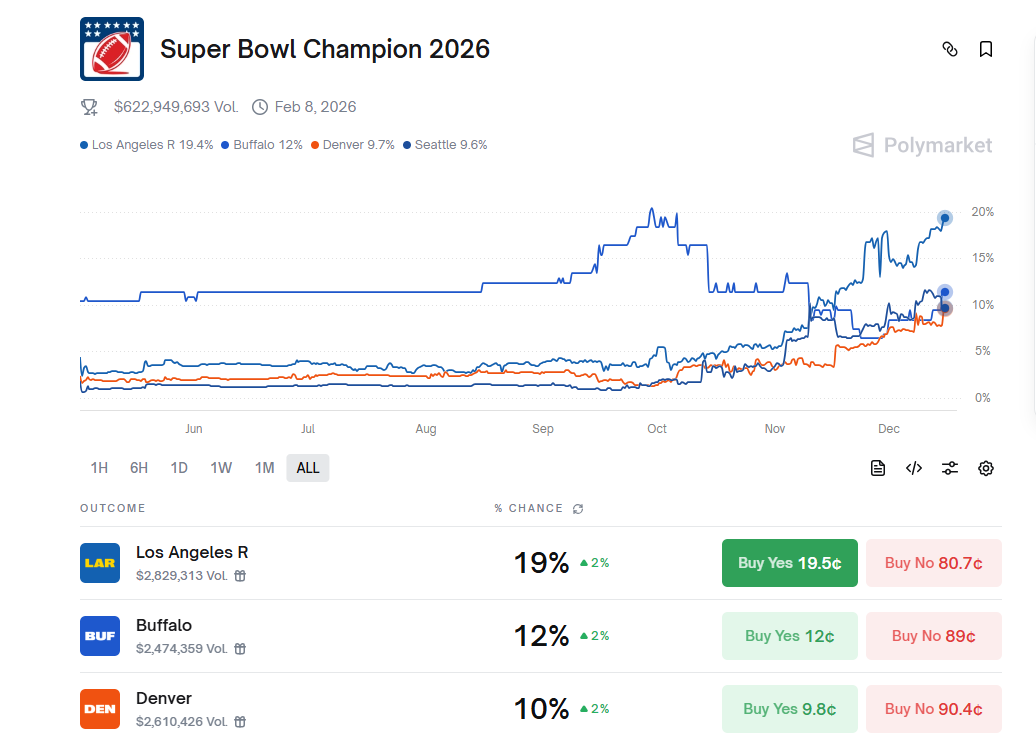

The gap between those early platforms and what exists in 2025 is enormous. Modern prediction markets like Polymarket operate in a completely different environment. They are built on blockchain technology, accessible globally, and designed for constant engagement. Unlike earlier platforms, today’s markets run 24/7, settle rapidly, and attract liquidity from thousands of users around the world. They feel closer to crypto trading platforms or betting exchanges than academic experiments.

In 2025, prediction markets are no longer limited to political insiders or economists. They are discussed openly on social media, referenced by mainstream commentators, and used by retail traders who may never have placed a traditional bet. Platforms like Polymarket blur the line between trading, gambling, and information gathering. Users speculate on elections, policy decisions, cultural moments, and economic outcomes in a way that feels familiar to anyone who has used a crypto exchange.

Another key difference is visibility. In the 1990s, prediction markets had almost no public profile. In the 2000s, they were niche but known to a small, informed audience. In 2025, they are visible, debated, and increasingly regulated. Partnerships with major financial platforms, legal battles in public courts, and constant online discussion have brought prediction markets into the open.

The audience has also changed. Early prediction markets attracted specialists. Modern platforms attract a mix of traders, gamblers, analysts, and casual users. The motivation is no longer purely about forecasting accuracy. For many users, prediction markets are a way to express opinion, manage risk, or seek profit in fast-moving news cycles.

Technology has been the decisive factor in this transformation. Blockchain settlement, stablecoins, and global access have removed many of the barriers that limited prediction markets in earlier decades. What once required explanation and patience now feels intuitive to users accustomed to digital wallets, exchanges, and instant price discovery.

In short, prediction markets in the 1990s were experimental and invisible, in the 2000s they were niche and fragile, and in 2025 they are robust, global, and culturally relevant. Platforms like Polymarket represent not just an evolution but a complete shift in how prediction markets function and how the public perceives them. They are no longer curiosities. They are part of a broader ecosystem of online trading and betting that continues to expand.

What were prediction markets in the 1990s?

In the 1990s, prediction markets were mostly small academic or corporate experiments used to test how groups forecast future events. They were not designed for the general public or gamblers.

Who used prediction markets in the 1990s?

They were mainly used by economists, researchers, and employees inside companies, not by everyday internet users or bettors.

Were prediction markets considered gambling in the 1990s?

No, they were usually framed as research tools or decision-making experiments rather than gambling products.

Could the public easily access prediction markets in the 1990s?

No, most were closed systems or limited-access platforms with no public marketing or awareness.

What changed in the early 2000s for prediction markets?

The rise of the internet allowed prediction markets to move online and become accessible to the public for the first time.

Which platforms made prediction markets more visible in the 2000s?

Platforms like Intrade helped introduce prediction markets to a wider audience, especially around political events.

Did gamblers use prediction markets in the 2000s?

Some did, but most online gamblers still preferred sports betting and casino games because prediction markets were complex and unfamiliar.

What types of events were traded in early online prediction markets?

They focused mainly on politics, economics, interest rates, and major world events rather than entertainment or sports.

Were prediction markets popular in the 2000s?

They were niche. Known to journalists, analysts, and politically engaged users, but not mainstream.

Why didn’t prediction markets grow faster in the 2000s?

Regulatory uncertainty, limited technology, low liquidity, and lack of public understanding slowed adoption.

What caused prediction markets to fade from public view after 2010?

Platform closures, legal pressure, and competition from traditional betting and financial products reduced visibility.

What makes prediction markets in 2025 different?

They are global, fast, highly liquid, and often built on blockchain technology, making them far more accessible and visible.

How has blockchain changed prediction markets?

Blockchain allows instant settlement, global access, transparency, and the use of digital currencies instead of traditional banking.

Why are platforms like Polymarket so different from earlier markets?

They operate 24/7, attract global users, integrate with crypto wallets, and feel similar to modern trading platforms.

Are prediction markets in 2025 aimed at gamblers?

They attract gamblers, traders, analysts, and casual users, blending elements of betting, trading, and opinion expression.

Do modern prediction markets include sports?

Some do, but many focus on politics, economics, culture, and current events rather than traditional sports betting.

Are prediction markets now mainstream?

They are far more visible than before, discussed in media and online communities, but still emerging compared to sportsbooks.

How do prediction markets compare to betting exchanges?

They are similar in structure but focus on probabilities and outcomes rather than odds set by bookmakers.

Why are bookmakers paying attention to prediction markets now?

Because prediction markets compete for user attention, liquidity, and event-based speculation.

Are prediction markets regulated in 2025?

Some are regulated in certain jurisdictions, while others operate in legal grey areas or offshore.

Did early prediction markets influence today’s platforms?

Yes, the core idea of aggregating crowd beliefs remains the same, even though the technology has changed completely.

Are prediction markets more accurate today than in the past?

They can be, mainly due to higher liquidity, faster information flow, and broader participation.

Why do people use prediction markets instead of polls?

Because market prices reflect money-backed opinions, which many see as more honest than surveys.

Are prediction markets considered gambling today?

Opinions differ. Some see them as financial instruments, others as betting, and regulators vary in classification.

How aware is the average gambler of prediction markets in 2025?

Awareness is growing, especially among crypto users, but many traditional gamblers still do not use them.

What role does social media play in modern prediction markets?

It drives discussion, attention, and rapid shifts in market prices based on breaking news.

Did prediction markets exist alongside online casinos?

Yes, but historically they developed separately and appealed to very different audiences.

Why do prediction markets feel more relevant today?

Because real-time news, digital trading habits, and global connectivity make them easier to understand and use.

Are prediction markets likely to keep growing?

Most signs suggest continued growth, especially as regulation and technology mature.

Why are prediction markets from the 1990s and 2025 considered worlds apart?

Because they differ in visibility, technology, audience, regulation, and cultural relevance, sharing only the basic idea of forecasting outcomes.