Prediction markets work by transforming beliefs about the future into tradable signals that can be measured, compared, and updated over time. They are built on the same principles as financial markets, but instead of trading shares in companies or commodities, participants trade contracts linked to the outcomes of future events. By observing how these contracts are priced and traded, prediction markets reveal how likely different outcomes are, according to the collective judgment of all participants.

At the centre of how prediction markets work is the idea of an outcome-based contract. Each contract is tied to a clearly defined future event and a specific outcome of that event. For example, a contract might be linked to whether a particular candidate will win an election, whether interest rates will rise by a certain date, or whether a new technology will reach mass adoption within a set timeframe. The contract typically pays a fixed amount if the outcome occurs and nothing if it does not. This simple payoff structure makes it easy to translate prices into probabilities.

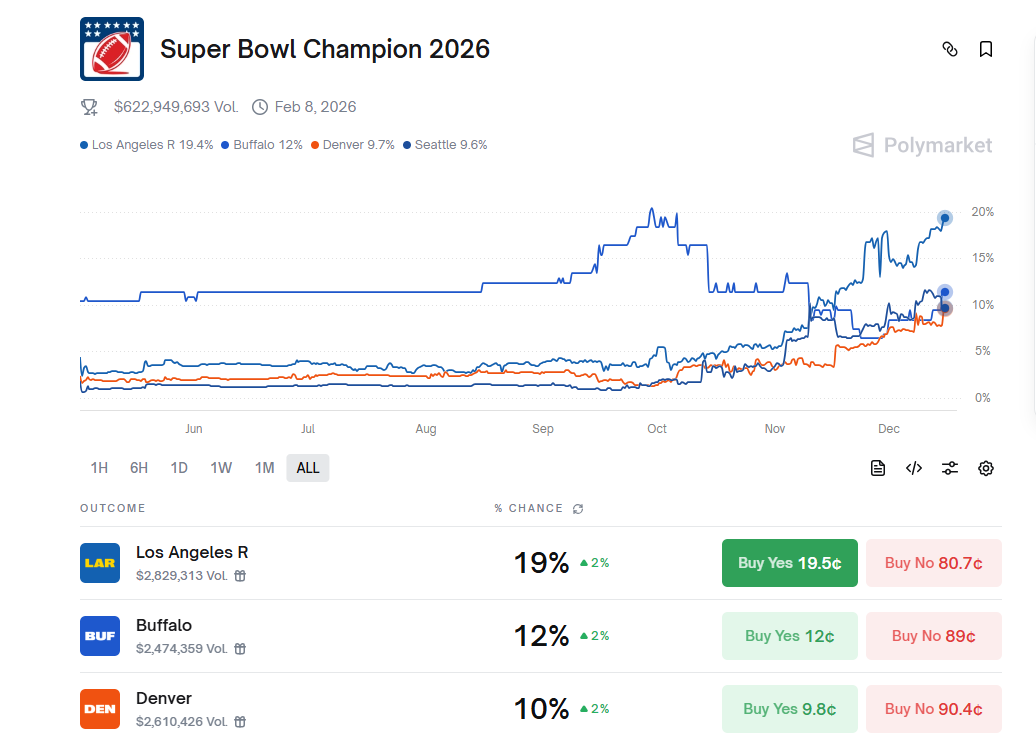

When a prediction market opens, participants begin trading these contracts based on their expectations. If someone believes an outcome is more likely than the current market price suggests, they can buy the contract. If they believe the outcome is less likely, they can sell it. As buying and selling continues, prices move up and down until they reflect the balance of beliefs and information among all traders. A price of sixty pence or sixty cents implies that the market collectively estimates a sixty percent chance that the outcome will happen.

The reason prediction markets work so well is the role of incentives. Participants are rewarded for being right and penalised for being wrong. This creates strong motivation to seek out information, analyse data carefully, and act honestly on one’s true beliefs. Unlike surveys or polls, where respondents may answer casually or strategically, prediction markets require participants to back their views with a stake. This tends to filter out noise and amplify well-founded judgments.

Another key element in how prediction markets work is information aggregation. Information about the future is scattered across many individuals. One person may have specialist knowledge, another may follow relevant news closely, and someone else may notice early signals others overlook. Prediction markets bring all of this dispersed information together into a single price. Even if no individual has a complete understanding, the market price can still be highly informative because it reflects the combined input of many independent perspectives.

Trading in prediction markets is supported by specific market mechanisms that ensure prices can form even when participation is limited. Some platforms use traditional order books, where traders post bids and asks at chosen prices. Others rely on automated market makers, which adjust prices algorithmically in response to trades. Automated market makers are especially common in newer or smaller markets because they guarantee that participants can always trade, even when there are few buyers or sellers at a given moment.

As new information becomes available, prediction markets update rapidly. A breaking news story, data release, or unexpected development can cause prices to shift within seconds or minutes. This responsiveness is a crucial part of how prediction markets work. It means that the market is constantly incorporating the latest available information, often faster than expert reports or formal forecasts. Over time, this process of continuous updating leads to increasingly refined probability estimates.

Prediction markets also rely on clearly defined rules for resolving outcomes. Before trading begins, the market specifies exactly how and when the outcome will be determined, and which source will be used to verify it. This could be an official government announcement, a published economic statistic, or another authoritative source. Once the event occurs and the outcome is confirmed, the market settles and winning contracts pay out. This clear resolution process is essential for trust and participation.

There are several different types of prediction markets, each illustrating how prediction markets work in slightly different ways. Binary markets focus on yes-or-no outcomes, such as whether an event will happen or not. Multi-outcome markets allow trading on several possible results, such as multiple election candidates or different economic scenarios. Some markets allow continuous outcomes, where the final payout depends on a numerical result falling within a certain range.

Prediction markets can operate with real money or with virtual currency. Real-money prediction markets tend to produce the most accurate forecasts because the incentives are strongest. However, they are subject to legal and regulatory constraints in many jurisdictions. Play-money markets remove legal barriers and are often used for education, research, or internal forecasting within organisations. While the incentives are weaker, well-designed play-money markets can still generate useful insights.

Within organisations, internal prediction markets demonstrate how prediction markets work in a practical decision-making context. Employees trade on outcomes such as project completion dates, sales targets, or product launches. These internal markets often outperform traditional planning methods because they encourage honest assessment and draw on knowledge from across the organisation, including insights that may not surface in meetings or reports.

Despite their strengths, prediction markets are not perfect. They require sufficient participation to function effectively. In thin markets with few traders, prices may be volatile or unreliable. They can also be influenced by biases if participants share similar viewpoints or lack diversity. However, as participation increases and incentives remain aligned, prediction markets tend to correct errors over time through the trading process itself.

Ethical and legal considerations also shape how prediction markets work in practice. Some topics are controversial, particularly when markets involve sensitive events such as public health crises or political instability. Regulators often struggle to classify prediction markets within existing legal frameworks, especially when real money is involved. These factors influence where and how prediction markets can operate.

Technological developments have expanded the ways prediction markets work. Online platforms have made them accessible to global audiences, while blockchain technology has enabled decentralised prediction markets that operate without a central authority. In these systems, smart contracts handle trading and payouts automatically, and decentralised oracles verify outcomes. These innovations aim to increase transparency, reduce censorship, and lower operating costs.

Ultimately, how prediction markets work can be summarised as a continuous process of belief, incentive, and information. Participants express their expectations through trades, prices adjust in response to new information, and the resulting price signals provide a real-time estimate of future probabilities. By aligning incentives with accuracy and aggregating diverse knowledge, prediction markets offer a uniquely effective way to forecast uncertain events and support better decision-making across politics, economics, business, and beyond.